Articles by Partner: Damien Duhamel

The UAE has long positioned itself as a magnet for global ambition—be it finance, logistics, or culture. With the announcement of Disney’s entry into the UAE market through a new destination on Yas Island in partnership with Miral, we are witnessing the beginning of a structural shift in how the country will compete in the global tourism and creative economy space. Disney’s move is not simply the addition of another theme park. It is a signal—one that affirms the UAE’s readiness to host premium, globally renowned brands within a highly regulated, visionary framework. It also represents a strategic inflection point with far-reaching economic implications.

How will Disney's entry reshape the UAE entertainment and tourism landscape?

Transforming the Entertainment and Tourism Landscape

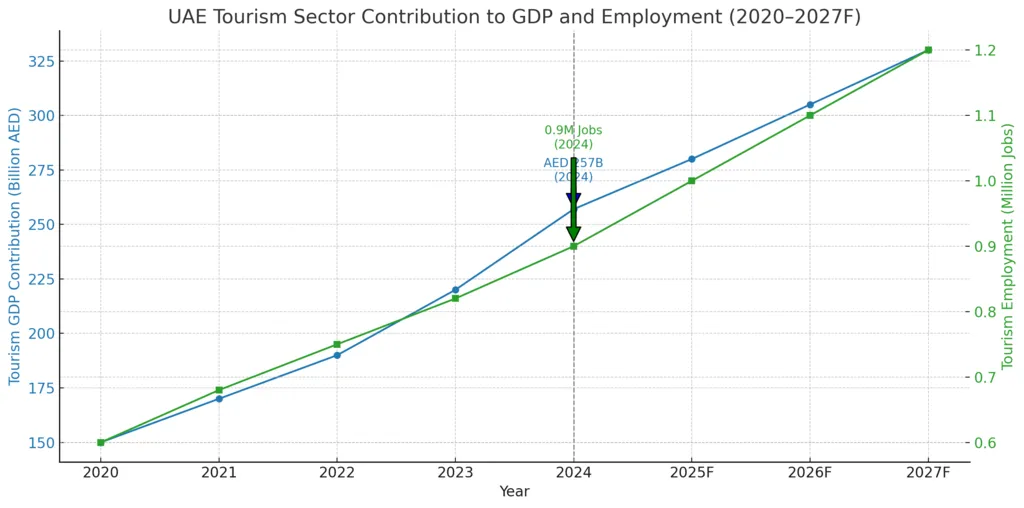

In 2024, tourism contributed over AED 257 billion to the UAE economy—roughly 12% of national GDP—supporting nearly 900,000 jobs. International visitors accounted for AED 217 billion in spending, with domestic tourism adding another AED 57.6 billion. And with over 120 million passengers processed at the country’s major airports, the infrastructure backbone to absorb a fresh wave of inbound demand is well in place.

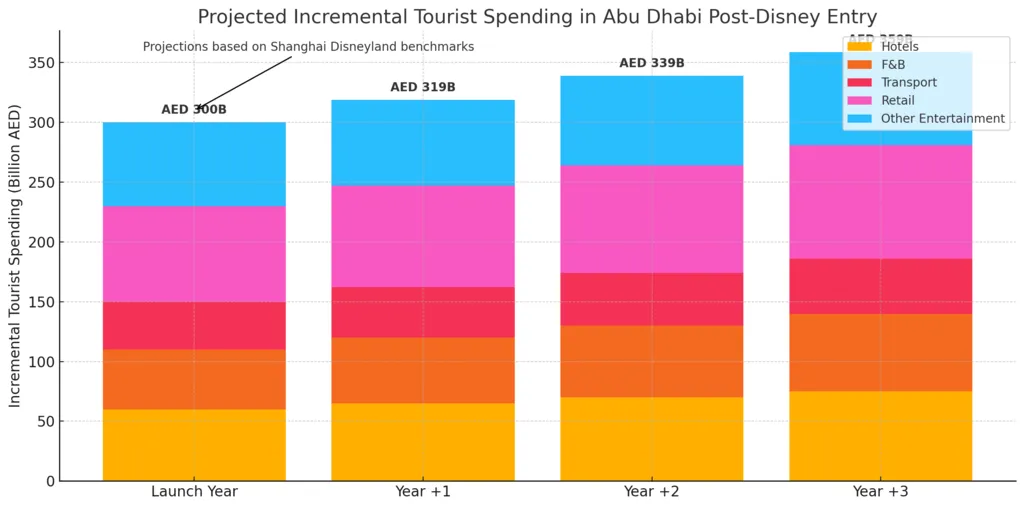

Disney’s presence will likely catalyze a tourism super-cycle. Looking to the Shanghai Disneyland precedent, which drew over 11 million visitors in its first year, we estimate Abu Dhabi’s park could attract a similar 10–12 million annual visitors once mature. That level of traffic is projected to inject AED 300–400 billion in incremental tourism-related spending over the first five years alone—benefiting not just the hospitality sector, but retail, logistics, aviation, and local infrastructure development. This will not displace existing assets. If anything, Disney’s gravity will expand the tourism pie, driving longer stays, repeat visitation, and cross-brand consumption. Yas Island, which welcomed approximately 38 million visits in 2024, will likely transform into a regional leisure cluster rivaling Orlando or Anaheim in strategic importance.

What strategic partnerships is Disney likely to pursue within the UAE?

A Playbook of Strategic Partnerships

True to its global operating model, Disney has opted for an asset-light, partnership-driven approach in the UAE. The alliance with Miral—Abu Dhabi’s tourism development arm—is emblematic of this strategy. Miral will finance, own, and operate the destination, while Disney licenses its brand and intellectual property, ensuring brand fidelity and global alignment.

We anticipate this is only the first of several strategic partnerships. Real estate giants like Aldar or Meraas may emerge as collaborators on adjacent residential and hospitality developments. Telco players such as e& or du could partner on AR/VR integration, guest connectivity, and smart park infrastructure. Higher education institutions and creative hubs—such as twofour54 and Dubai Studio City—are likely to support workforce development in animation, storytelling, and hospitality leadership.

This partnership web will extend to aviation and retail. Emirates and Etihad could co-create bundled travel experiences with park access, while regional retailers and F&B brands will have the opportunity to join Disney’s licensing and merchandising ecosystem.

How does Disney's market entry align with the UAE's Vision 2031 for economic diversification?

In Step with UAE Vision 2031

The timing of Disney’s arrival is aligned with the UAE Vision 2031, which prioritizes diversification away from hydrocarbons and toward knowledge, experience, and innovation-led growth. In Q1 2024, the UAE’s non-oil economy expanded by 4% year-on-year. Sectors such as tourism, retail, and hospitality—core to Disney’s model—grew between 4.2% and 4.6% in the same period.

Disney’s market entry feeds directly into these ambitions. It will generate thousands of new jobs across creative, operational, and digital functions. It will also promote SME participation, particularly in merchandise production, logistics, and events. Perhaps most critically, it enhances the UAE’s soft power by associating the nation’s identity with one of the most powerful family entertainment brands in the world.

In an economy projected to see non-oil GDP growth of 5.4% in 2024 and 5.3% in 2025, Disney’s multiplier effect on growth, employment, and foreign direct investment will be material and sustained.

What potential does Disney's presence hold for the local creative and media sectors?

Building a Creative and Cultural Economy

One of the most underappreciated aspects of Disney’s UAE market entry is its potential to professionalize and internationalize the local creative sector. With demand for regionally adapted content, local voice acting, set design, and event production, Disney will serve as a benchmark and incubator for regional talent.

Expect to see Emirati content creators contributing to Disney-licensed material. Expect youth academies focused on storytelling, digital design, and immersive experiences. Expect local studios to be upgraded to meet Disney’s global standards for quality and workflow. These are long-term, high-multiplier investments that go beyond real estate and footfall.

If properly harnessed, this can become the launchpad for a new generation of Arab creative entrepreneurs who will serve not only Disney but the broader media and cultural landscape emerging across the Gulf.

How will local competitors and regulatory frameworks respond to Disney's expansion?

Competitive and Regulatory Dynamics

Disney’s entry will inevitably force a recalibration of the UAE’s entertainment ecosystem. Peer parks such as Motiongate, IMG Worlds, and Legoland will face pressure on pricing, service quality, and IP depth. But this should not be seen as a threat—rather as an opportunity. Smart operators will differentiate through localized storytelling, bundling, and off-peak activations.

Regulatory bodies will also need to adapt. Disney’s standards around safety, accessibility, and content licensing may prompt the UAE to evolve its frameworks, particularly around IP protection, content rating systems, and immersive tech deployment. Given the UAE’s strong track record in agile governance, we expect this adaptation to be both timely and constructive.

Conclusion: A Defining Moment for the UAE’s Economic Narrative

The Disney UAE Market Entry is not an isolated investment—it is a strategic alignment between a world-class brand and a nation rewriting the rulebook for post-oil prosperity. It reinforces the UAE’s ambition to become the region’s cultural and economic engine, not just in financial terms, but in emotional, experiential, and societal capital. This is not a park. It is a platform—for growth, for storytelling, for vision.

For investors, operators, and policymakers, now is the moment to act. The foundations have been laid. The brand is arriving. The opportunity is real and will transform Abu Dhabi, the UAE and the Middle East.